Navigating Beneficiary Disputes in Life Insurance Claims: Guidance for a Fair Resolution

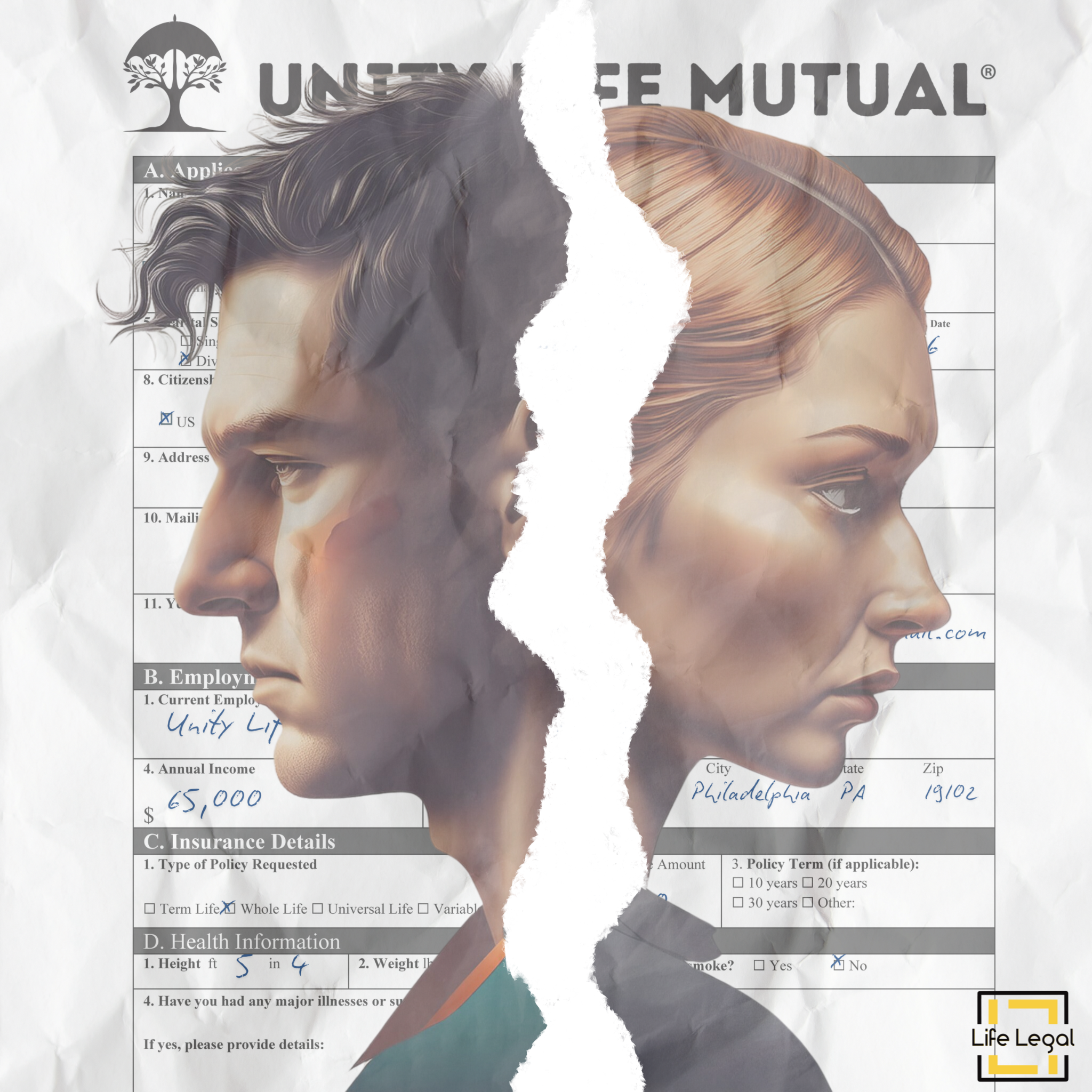

Navigating disputes between beneficiaries in life insurance claims can be one of the most challenging aspects for clients dealing with life insurance companies. As a life insurance attorney, I often meet clients frustrated and overwhelmed by these conflicts. Such disputes can transform a problematic situation into a contentious and stressful ordeal. However, these issues can be resolved fairly and efficiently with the proper guidance and approach. In this blog, I’ll provide essential information on resolving beneficiary disputes and ensuring a fair distribution of life insurance payouts.

Understanding Beneficiary Designations

First and foremost, it’s essential to understand the importance of beneficiary designations. When a policyholder takes out a life insurance policy, they name one or more beneficiaries to receive the death benefit upon their passing. These designations are typically straightforward but can become contentious if:

- Multiple beneficiaries are named without clear instructions on the division of funds.

- Beneficiaries are unaware of the policy or their designation.

- Changes to the beneficiary designations were made while the insured was ill, highly medicated, or the change was sudden or unexplained.

Steps to Resolve Beneficiary Disputes

- Review the Policy Documents: The initial step is thoroughly reviewing the life insurance policy and related documents. This includes the original application, amendments, and the most recent beneficiary designation form. Ensure you have a clear understanding of the policyholder’s intentions.

- Communicate with the Insurance Company: Engage directly with the life insurance company to clarify any ambiguities in the policy documents. Insurance companies must follow the policyholder’s instructions as stated in the policy. Request detailed explanations of their decision-making process if a dispute arises.

- Gather Evidence: Collect evidence supporting your claim and/or which disputes another beneficiary’s claim. This could include emails, letters, or other communications from the policyholder indicating their intentions and any documentation showing changes to beneficiary designations.

- Mediation and Negotiation: Consider mediation or negotiation before escalating to filing a lawsuit. This process involves a neutral third party who can help facilitate discussions and propose a fair resolution. Mediation is often less adversarial and can preserve relationships between disputing parties.

- Legal Action: If mediation fails, the next step may involve filing a lawsuit. In such cases, a judge or jury will determine the rightful beneficiaries based on the evidence presented. This can be a lengthy and costly process, so it’s usually considered a last resort.

Ensuring Fair Distribution

To ensure a fair distribution of the life insurance payout, consider the following proactive measures:

- Clear and Updated Beneficiary Designations: Regularly update beneficiary designations to reflect life changes such as marriage, divorce, birth of children, or other significant events. Ensure all beneficiaries are informed of their status.

- Detailed Instructions: Provide explicit instructions on how the death benefit should be divided among multiple beneficiaries. This can prevent confusion and disputes later on.

- Legal Advice: Consult with a life insurance attorney when making significant changes to your policy or if you foresee potential disputes among beneficiaries. Legal advice can ensure that your intentions are clearly documented and legally binding.

- Communication: Maintain open communication with your beneficiaries about your life insurance policy and your wishes. Transparency can prevent misunderstandings and disputes after your passing.

Conclusion

Navigating beneficiary disputes in life insurance claims can be challenging, but with the right approach, you can achieve a fair and equitable resolution. By understanding the intricacies of your policy, communicating effectively, gathering evidence, and considering mediation before litigation, you can protect your rights and ensure the policyholder’s wishes are honored. If you find yourself in a dispute, seek the guidance of a knowledgeable life insurance attorney to help you through the process.

Remember, the goal is to honor the intentions of the policyholder and ensure that all beneficiaries receive their rightful share. With careful planning and clear communication, you can minimize the potential for disputes and provide a smoother resolution for everyone involved.