Understanding the Difference Between Independent Life Insurance Policies and ERISA-Governed Life Insurance

Key Highlights:

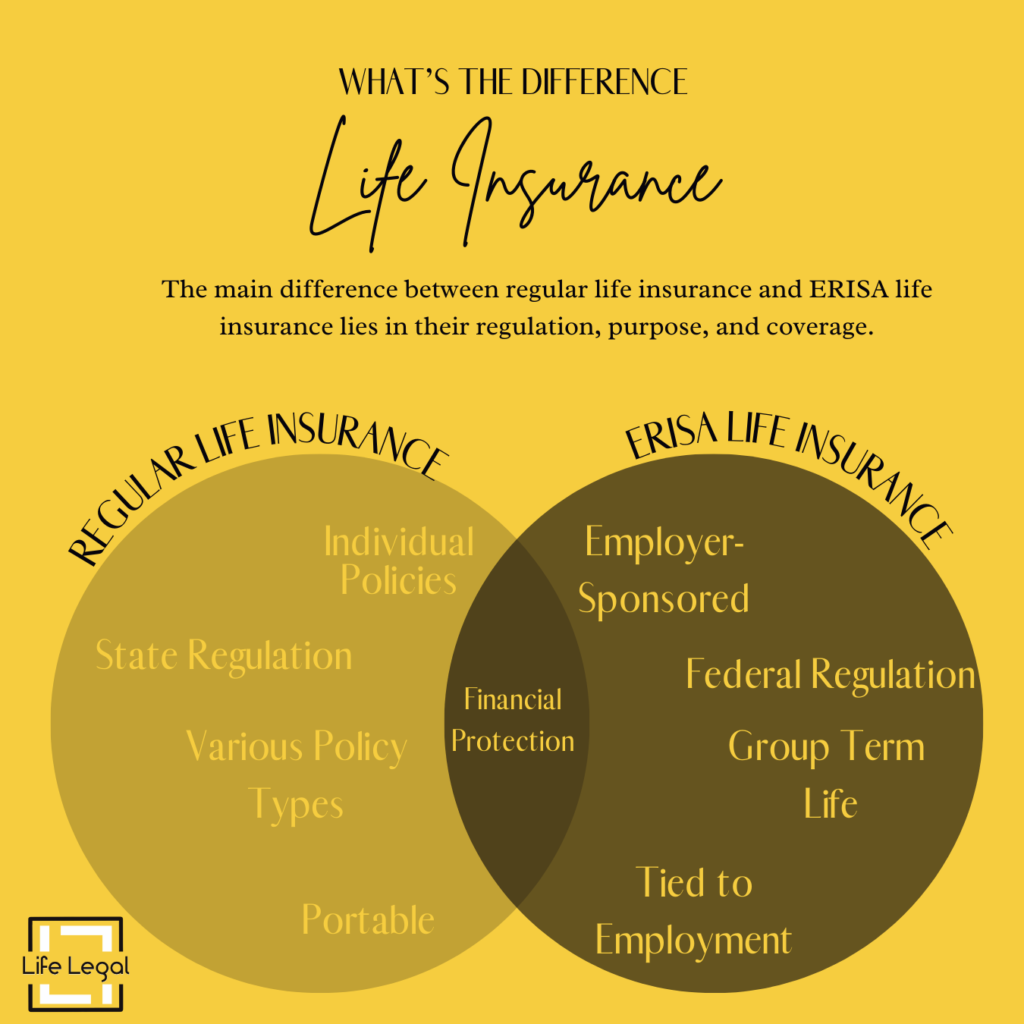

Ownership and Control: Independent life insurance policies are bought directly from an insurance company and are controlled by the individual, allowing for customization and portability across jobs.

Employment Ties: ERISA-governed life insurance is provided by employers as part of a benefits package and usually ends when you leave the job, though conversion options may be available.

Regulation Differences: Independent policies are regulated by state laws, while ERISA policies follow federal standards ensuring fiduciary responsibility and participant protections.

Cost and Premiums: ERISA-governed policies often have lower premiums due to group rates, whereas independent policies’ premiums depend on personal health and lifestyle factors.

Although most people nowadays have heard of independent life insurance policies, it’s also not uncommon for a person’s employer to offer life insurance as an employee benefit. Many employees are unaware of a few significant differences between these two types of life insurance coverage that may significantly affect their rights under the policy and how their claims may be handled. Understanding the differences between these can help you make more informed decisions about your coverage and, when necessary, can help you determine what type of attorney can best assist you if you run into trouble.

Independent Life Insurance Policies

Independent life insurance policies are those you purchase directly from an insurance company, independent of your employer. Here are the key characteristics:

- Personal Ownership: You own the policy and have some control over its terms and conditions. You choose the insurance company, coverage amount, beneficiaries, and payment schedule.

- Flexibility: Since the policy is independent of your employment, it stays with you even if you change jobs, become unemployed or disabled, or retire. You can customize it to fit your specific needs without restrictions imposed by an employer.

- Regulation: Independent policies are regulated by state insurance laws. These laws vary from state to state but generally require insurers to maintain financial stability and treat policyholders fairly.

- Premiums: The cost (premium) is determined based on personal factors such as age, health, and lifestyle. Premiums can be higher or lower depending on these individual risk factors.

- Claims Process: When a claim is made, it is handled directly between the policyholder (or their beneficiaries) and the insurance company, following the company’s specific procedures.

ERISA-Governed Life Insurance Policies

ERISA-governed life insurance policies are typically offered as part of an employee benefits package. ERISA stands for the Employee Retirement Income Security Act. This federal law sets minimum standards for most voluntarily established retirement and health plans in private industry to protect individuals in these plans. Here’s how ERISA impacts life insurance:

- Employer-Sponsored: These policies are part of a group plan provided by your employer. You may receive basic coverage at no cost or have the option to purchase additional coverage through payroll deductions.

- Portability: Unlike independent policies, ERISA-governed policies are generally tied to your employment. If you leave your job, you may lose the coverage unless there is a provision to convert it to an individual policy, which is usually more expensive.

- Regulation: ERISA sets standards to ensure that plans are managed in the best interests of the participants. This includes fiduciary responsibilities for plan managers, ensuring they act prudently and solely in participants’ interest.

- Premiums: Premiums are often lower than those for independent policies because they are part of a group plan, spreading the risk among many participants. The rates are typically not based on individual health factors.

- Claims Process: Claims are processed through the plan administrator, who is required to follow ERISA guidelines. If a claim is denied, ERISA provides specific procedures for a limited number of appeals so that participants can contest the denial.

Key Differences and Considerations

When deciding between independent life insurance and an ERISA-governed policy, consider the following:

• Control and Customization: Independent policies offer more control and customization, which can be tailored to your specific needs and circumstances.

• Stability and Portability: Independent policies provide stability and portability, remaining with you regardless of job changes.

• Cost: ERISA-governed policies are usually more cost-effective due to group rates.

• Regulation and Protection: ERISA offers more protections for plan participants, ensuring fiduciary responsibility and a structured appeals process for denied claims.

Both types of policies have advantages; choosing the right one depends on your circumstances, job stability, and financial planning needs. Once that decision is made, it’s essential to understand what rights you have as an insured and/or policy beneficiary to make claims and effectively appeal adverse claim determinations. Consulting with an attorney well-versed in ERISA and state insurance laws, like the attorneys at Life Legal, will help you navigate complex life insurance issues and ensure that life insurance benefits are paid according to the insured person’s original intent.